Trump’s tax reform that boost dollar seems to be short-lived, sell USD/JPY?

Trump sold tax reform plan that calls for sweeping tax cuts and a simplification of the tax code

US dollar strength could return in the fourth quarter as President Trump finally unveiled his tax reform plan, but the strength could just stay for weeks or months. We think the tax cut is not likely to be substantial enough to lift the consumption. Fed’s unwinding and its rates’ setting will be the driver for dollar’s long-term trend.

US President Trump last week unveiled the Republican framework for tax reform that calls for sweeping tax cuts and a simplification of the tax code, while some details remained to be filled in. The framework would reduce the top corporate tax rate from 35% to 20% and individual tax rate from 39.6% to 25%. No details of the plan have been offered, including the elimination of taxes on large inheritances and deep reductions in the rates paid by large and small businesses.

According to analysis issued last Friday by the Tax Policy Centre, Trump/GOP plan would actually increase taxes on non-business individual income by $470 billion, while reducing taxes on business income by $2.6 trillion over the next decade. In other words, highly paid employees are the big losers. This piece of estimate offered an important clue to the market: this round of dollar rally may not be sustainable. US corporate earnings and business sentiments have been substantially improved in past 12 months, with nation’s unemployment rate continued to fall to new lows. However, improving corporate earnings and labour market conditions failed to boost the consumption. Inflation of the world’s largest economy remained subdued and showed no sign of reaching Fed’s target at 2%. Personal consumption is a key factor driving the pace of Fed’s rates setting. US Treasury market looked calm on the tax reform news. Front-end of the US curve was steady, with 7-10y sector underperforming as yields gained 1-1.5bps.

In conclusion, we think markets’ focus in the long run will be on Fed’s plan. Its balance-sheet runoff may mean greater volatility and higher yields over the next few years. These could mean more room for the safe assets like yen and gold to rise, pressuring dollar lower.

NOTE: Trading volumes are very low these days as financial markets in India, South Korea and Hong Kong are closed today for holiday, and Chinese market is closed for the entire week.

Our Picks

EUR/USD – Slightly bearish.

This pair may fall towards 1.1718 this week, as investors react to the clashes in Spain over a banned Catalonian independence referendum.

USD/JPY – Slightly bearish.

Possibility of US stocks to consolidate may drive demand on yen. This pair may dip towards 111.80.

XAG/USD (Silver) – Slightly bearish.

We expect price to drop towards 16.10 this week.

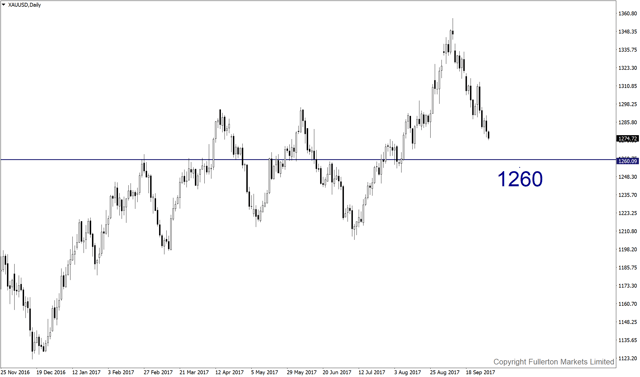

XAU/USD (Gold) – Slightly bearish.

We expect price to fall towards 1260 this week.

Top News This Week (GMT+8 time zone)

Australia: RBA rate decision. Tuesday 3rd October, 11.30am.

We expect figures to remain unchanged at 1.50%.

US: Nonfarm payrolls. Friday 6th October, 8.30pm.

We expect figures to come in at 95k (previous figure was 156k).

0 comments:

Post a Comment