The text here is primarily from Dr Alexander Elder's monumental book, "Trading For A Living" . I added in some of my own to give it a nice Forex Twist!

Each price is the momentary consensus of value of all market participants. When bulls feel strongly bullish, they buy more eagerly and push markets up. When bears feel strongly bearish, they sell more actively and push markets down.

Each price reflects action or lack of action by all traders in the market. Charts are a window into mass psychology. When you analyse charts, you analyse the behaviour of traders.

Ask most traders why prices go up, and you are likely to get this answer: more buyers than sellers. This is NOT true. The number of contracts bought and sold in ANY market is ALWAYS EQUAL.

If you want to buy a contract of Swiss Francs, someone has to sell it to you. If you want to sell a contract of Japanese Yen, someone has to buy it from you. This means that the number of long and short positions in the market is always equal.

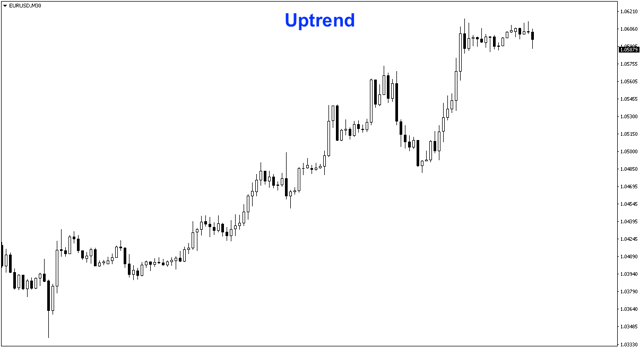

Prices move up or down because of changes in the INTENSITY of greed and fear among buyers or sellers. When the trend is up, bulls feel optimistic and do not mind paying a little extra. They buy high because they expect prices to rise even higher. Bears feel tense in an uptrend, and they agree to sell only at a higher price.

When greedy and optimistic bulls meet fearful and defensive bears, the market rallies. The stronger their feelings, the sharper the rally. The rally ends only when many bulls lose their enthusiasm. When prices slide, bears feel optimistic and do not quibble about selling short at lower prices.

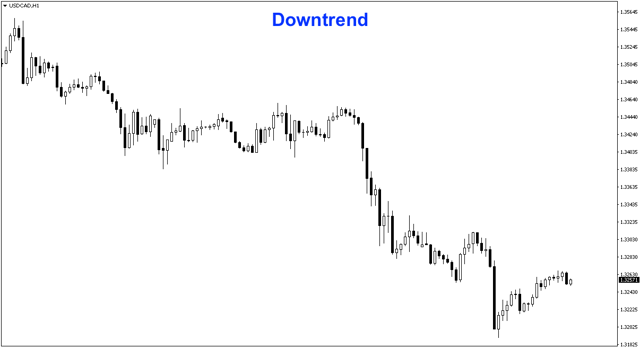

Bulls are fearful and agree to buy only at a discount. As long as bears feel like winners, they continue to sell at lower prices, and the downtrend continues. It ends when bears start feeling cautious and refuse to sell at lower prices.

Few traders act as purely rational human beings. Most market participants act on the principle of "monkey see, monkey do." The waves of fear and greed sweep up bulls and bears. Markets rise because of greed among buyers and fear among sellers.

Bulls normally like to buy on the cheap. When they turn very bullish, they become more concerned with not missing the rally than with getting a cheap price. A rally continues as long as bulls are greedy enough to meet sellers' demands.

Markets fall because of greed among bears and fear among bulls. Fearful buyers agree to buy only below the market. As long as sellers are willing to meet those demands, the decline continues.

Either way, you need to base your trades on a carefully prepared trading plan and not jump in response to price changes. It pays to write down your plan. You need to know exactly under what conditions you will enter and exit a trade.

Do not make decisions on the spur of the moment - this is when you are most vulnerable to being sucked into the crowd.

0 comments:

Post a Comment