Draghi seems to have no concern over a strong euro, good to buy EUR/USD?

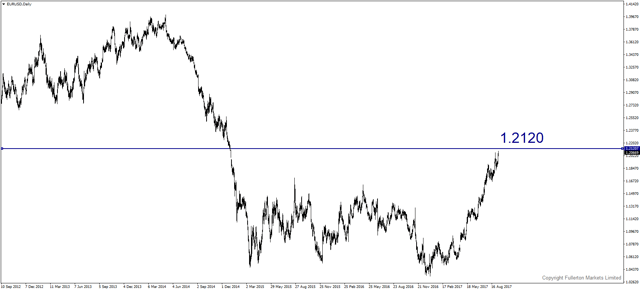

Euro surged on Thursday after ECB indicated they are preparing to scale back its stimulus program. Draghi’s message revealed ECB’s higher tolerance on euro strength moving forward.

- ECB may soon discuss QE exit strategy as early as next month and execute the plan as early as beginning of 2018. Such expectation may extend the gain in euro in coming months.

- ECB expects inflation to be at 1.2% next year versus 1.3% previously, and to be at 1.5% in 2019 from previous forecast of 1.6%. However, they raised its economic growth forecast this year to 2.2%, which is the highest since 2007. Lower inflation forecast with stronger growth suggests ECB has a higher tolerance on stronger euro now.

- When US Fed started to taper their QE at the end of 2014, US dollar rallied more than 20% until end of last year. Hence, if ECB starts to taper, euro will most likely repeat the dollar’s trend.

0 comments:

Post a Comment