One of the most popular questions I’ve received in my speaking engagements is "When is the BEST time to trade Forex?"

Now, my normal answer is "ANYTIME is a good time” but that answer almost always draws sighs from the crowd.

I say "ANYTIME is a good time" primarily because the Forex Market is open 24 hours a day, 5 days a week from Monday to Friday. The lack of a physical exchange allows the Forex Market to conduct business on a 24 hour time frame across the chief financial centres. That's why the Forex Market is sometimes known as an "Over-The-Counter" Market.

When you are supposed to take a trade, TAKE IT. This means that if the trade set-up fits the rules of your trading plan, take the trade regardless of the time. Of course, do exercise some common sense here. In no way am I asking you to forego your beauty sleep and stay glued to the computer screen! Your spouse would come chasing after me!

On the flip side, when you are not supposed to take a trade, DON'T TAKE IT. This means that if the trade set-up doesn't meet ALL the rules of your trading plan, you shouldn't even be thinking about entering the trade.

I know this is pretty much common sense, but it's always easier said than done. Another word of advice: don't kick yourself if you miss a trade - who said THAT trade would definitely register a WIN anyway?

There are TONS of other opportunities waiting.

Ok, coming back. Let's delve a little more into the topic at hand.

Is there really such a thing as the BEST time to trade? I mean, is there some theory which shows "taking a trade at 3pm has a higher chance of winning than executing one at 6am?" You probably know where I'm heading with this one.

However, I shall attempt to shed some light to the statement "BETTER TIMES to trade" rather than "best times".

To start off, let's understand a little more on the "opening hours" of certain financial exchanges. This is important to establish because admittedly, MORE VOLUME switches hands during these periods. This leads to more volatility in the Forex Market (which is a good thing if we want to catch pips).

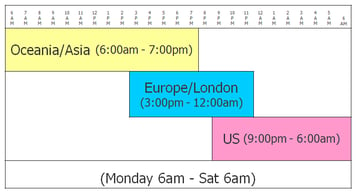

Take a look at the picture below:

In a nutshell, this tells us that the financial markets open in the following order: New Zealand --> Australia --> Japan --> Singapore --> India --> Europe --> London --> New York.

Trading starts in Wellington and ends in New York.

The OVERLAPS of these time zones are particularly noteworthy, since more volume is present when more exchanges are "open" so to speak.

Hence, the OVERLAP PERIODS of:

1) Asia Closing, Europe Opening

2) Europe Closing, US Opening

typically present "more trading opportunities" due to its heavier volume (which leads to more movements).

If you are staying in the GMT+8 time zone (countries like Singapore, Malaysia, Philippines, Taiwan, Hong Kong etc), I've got some particularly cool news for you. Check this out:

Let's say you wake up around 7.30am to prepare to go to work. What Markets are open? New Zealand, Australia and Japan. This means that the currency pairs of NZD/USD, AUD/USD and USD/JPY are particularly active. Can you place a trade then? Absolutely!

You then head to work. During your "tea-break" which is about 3pm, the currency pairs of EUR/GBP, EUR/USD, GBP/USD and USD/CHF would be more active. Should you check out the markets? Most definitely!

When you're home which is hopefully around 7pm (unless you've sold your soul to the office), go have your dinner, take a shower, play with the kids and prepare for the US market to open. This is when most of the major pairs are active, including USD/CAD. Good time to spot a trading set-up? Of course!

So you see, there isn't a BEST time to trade, but with the knowledge of the opening/closing hours of certain markets, there are BETTER TIMES to catch the VOLATILITY of the markets.

And if you are staying in the GMT+8 time zone, I've just shown you how you can integrate your trading WITHOUT any hassle to your daily life AT ALL! You'll still be in the running for Star Performer of the Year!

What time is it? It's trading time!

0 comments:

Post a Comment