Having had the privilege of speaking to audiences worldwide about Forex trading worldwide, I have noticed a common question: “What is the best strategy to trade Forex?”

Each time I hear the question, I can’t help but smile. After all, that was my biggest question when I first started trading Forex. It’s almost always, “Give me the strategy first, and we’ll talk about trading later!”

In this article I hope to shed some light on successful trading, and how we can all get there. Let’s start with the definition of a successful trader. The benchmark of a successful trader is that he or she must be consistently profitable.

Notice the word ‘consistently’. I’m never impressed when I hear someone is “making 500 per cent in a month”. Don’t get me wrong – these are amazing results; but any trader worth his salt must know that his game plan is to stay consistently profitable. It seems inevitable that the few who make exorbitant returns in one month get washed out the very next month, because they probably took on (and continue to take on) excessive risk.

Remember - you might be able to make 500 percent a month for a particular month, but all you need is to lose 100 percent once and you are out of the game forever.

The Three Laws

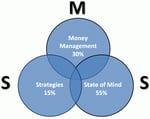

How does one become ‘consistently profitable’ in the Forex market? I would like to share my three laws of successful trading. They are not mutually exclusive. Rather, they must go hand-in-hand. They are:

- Strategies

- Money Management

- State of Mind

Strategies

There are four basic strategies to profit in the Forex market: Trend, Range, Breakout and News Release strategies.

Trend Strategy

A trend strategy is employed when the market is clearly in an uptrend or a downtrend. When the market is in an uptrend, go ‘long’. If the market is in a clear downtrend, go ‘short’. This is, by far, the most popular method of banking profits in the Forex market. As the saying goes: ‘The trend is your friend until it bends.’

Range Strategy

A range occurs when the market is trading in a channel – between a floor and a ceiling. The price seems to bounce repeatedly between the two areas called support and resistance. For this strategy, traders tend to sell near levels of resistance because buying pressure succumbs to selling pressure. This action pushes the price down. Conversely, traders execute buy orders near areas of support because selling pressure succumbs to buying pressure, which pushes prices up.

Breakout Strategy

A breakout strategy is employed when prices finally break out of a trading channel and head either up or down. Momentum is greatest on breakout points; hence traders tend to capitalise on these specific movements by going long once prices break upwards from a trading range, or short once prices break downwards from a trading range.

News Release Strategy

I know a number of traders who trade exclusively around the news. Two of the most popular news announcements are interest rate changes from the G7 countries and the Non-Farm Payrolls from the United States on the first Friday of every month.

Because there is no telling which way the market is going to react once the news is announced, do be careful on how you place your orders. Some traders will place pending orders before the actual news is released while others tend to wait until the actual figures are out.

There is no “one correct way” to trade the news. The best advice I can give is to start off with a demo account and trade around the news using a demo account first. Get used to the volatility during news release times and only graduate to a LIVE account once you’re confident of making money on the demo account. A good site to stay updated on news release is Forex Factory (www.forexfactory.com).

Money Management

Much can be said around the topic of money management; but I’d like to focus on just one aspect:

Risk.

In the world of retail Forex trading, many promising traders are still oblivious to one of the biggest pitfalls of trading: the tendency to take on too much risk.

Sometimes traders just do not understand how much risk is too much. The golden rule is never to risk more than one to five percent of your capital on any trade. In fact, I know many professional traders who consider five per cent to be too much. Some of them never go beyond two per cent.

What does this mean, specifically? If you have a trading account of USD10,000, a two per cent risk means that you will not lose more than USD200 if your stop loss is hit.

If we assume your stop loss is hit, then for your next trade you would begin with a capital of USD9,800. It is hard to imagine anyone blowing up his or her account with such tight rules; but the sad fact is that traders are unaware of how they should practice prudent money management.

Here’s an example to drive home the absolute importance of money management. If you start with an account of USD10,000, you would have USD5,000 left if you blew off 50 per cent of your account. The real question is how much you would have to make in order to bring your account back to the break-even level of USD10,000.

The answer, of course, is 100 per cent. In fact, the statistics are not pretty (see figure 1).

We are often reminded: “Amateurs are concerned with how much they can make. Professionals are concerned with how much they will lose.”

State of Mind

State of mind concerns a trader's thoughts and emotions. It is by far the biggest stumbling block to a trader's success. Four human characteristics – fear, greed, hope and ignorance – will always be a part of every trade.

Imagine you have just completed your ‘apprenticeship’ trading the demo account and you are now ready to trade LIVE. The first opportunity opens up. It’s time to make big bucks. However, when it’s time to execute the trade, you somehow freeze up. Your finger just can’t find the energy to click the mouse. This is fear. You then watch in horror as your trade (which you didn’t take) goes on to register a win!

At your next trade, you double your lot size. This is greed. You double your lot size because you want to win back the money you left at the table by not taking the first trade. As Murphy’s Law would have it, this trade is now heading towards your stop loss! You then do the unthinkable – you remove the stop loss. This is ignorance. You remove your stop loss because you are giving the trade some ‘breathing space’ to reverse and, hopefully register first win. Sound all too familiar?

I hope (no pun intended) that you now see that all three laws – strategies, money management and state of mind – must come into play for you to achieve any degree of success in trading. In fact, if we assume that the three circles make up 100 per cent of a trader’s success, then they can be divided as follows:

- Strategies: 15%

- Money management: 30%

- State of mind: 55%

Strategies (15%)

Even when your strategies work, it is a fact that they account for only 15 per cent of your success in trading.

Money management (30%)

Money management is twice as important as strategy because if you take on more risk than you are allowed, you put yourself in a position where your account can be badly damaged. Remember, it takes more effort to recover an account that has a significant drawdown.

State of mind (55%)

State of mind is twice as important as strategy because everything rises and falls on the way you, the trader, execute your plan.

Strategies and money management can be taught. Strategies are what to do. Money management is how much to do. However, state of mind -– thoughts and emotions – is difficult to control. Humans are emotional creatures and money is an emotional topic.

In summary, the three laws – strategies, money management and state of mind – must work in harmony before you can be consistently profitable in the Forex market.

0 comments:

Post a Comment