To most traders, the very title itself would raise a few eyebrows.

Support AND resistance are by far the most important day-trading technical analysis elements used by most traders. They are like two peas in a pod. The understanding of BOTH support and resistance are crucial to every trader’s arsenal of tools.

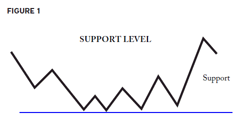

To re-cap, “Support” can be thought of as a floor for the price. This is an area where the buying pressure exceeds the selling pressure and pushes prices upwards (see Figure below).

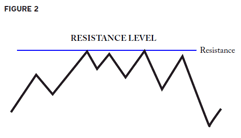

“Resistance” can be thought of as the ceiling for the price. This is an area where the selling pressure exceeds the buying pressure and pushes prices downwards (see Figure below).

The topic of Support & Resistance discussed here is with a twist. It is in reference to a trader’s lifestyle – are YOU trading with support OR resistance?

I have been trading the Forex Market for a couple of years now, and I realise that ONE thing above all else, is able to help a trader increase his success dramatically – having a solid system of support.

Support here is defined in several ways:

1) A community of like-minded traders

2) A structured system of teaching new traders

3) An existing system of coaching intermediate/mature traders

Why is support important for a trader? Well, with proper support, a new trader can immediately pick up the right learning techniques from the start and save precious time in the learning process.

An intermediate trader is also able to correct himself when bad habits start to creep into his trading lifestyle by benchmarking his progress against other successful traders.

A mature trader can utilise the support system to back-test his trades and offer his experience to new traders.

Building a Support System

There are three points to remember in getting trading support: M for mentor, A for attitude and P for platform.

- MentorDoes the support system provide you with a mentor? A mentor or a coach is basically someone to help you get to where you want to go. Preferably, someone who has considerably more experience than you. A good way to gauge whether one is a good mentor or not is by reviewing his personal results over a period of time.

- AttitudeThis one comes from you. However polished or robust the trading support system is, you need a great attitude to get the most out of it. Remember that “Your attitude determines your altitude.” When you carry a great attitude to learning and growing, you are not far away from achieving tangible results from your trading.

- PlatformWhat platform does the trading support provide? Are new traders able to attend regular classes? Is there online support? With the explosion of the Internet, some of the best support systems are fully integrated online, where traders are able to access a wealth of information by the snap of their fingers. These support systems also provide a one-stop solution to resolving trading enquiries and a framework of archived trades where traders can check and correct themselves.

On Trading Resistance

Many traders are immediately resistant to one or a few of the following points when they they embark on this enthralling Forex journey:

1. Achieving consistency and discipline;

2. Following a structured trading plan;

3. Trading with proper risk management;

4. And understanding that “the best strategy” is NOT the key to success - money management and trading psychology is.

Do a quick-check on the following 3 points to ascertain if you “trading with resistance”:

- LossesAre you experiencing a string of losses? If you are, it might be a time to sit down and review your trading plan. Are you sticking to it? Did you follow the rules? Did you allow your emotions to get the better of you? A string of losses is enough to demoralise any trader. However, this is probably the time for you to review if you have been sticking to your original rules.

- InconsistencyInconsistency is the bane of most traders. Nothing kills your account more than inconsistent trading. Are you “throwing caution to the wind” and taking trades at your whims and fancies? Are you playing with 10 lots because “you feel like it?” When you trade with an inconsistent pattern, not only will you be counting on luck, the forex market will also make you pay for it if you do.

- EgoYou know what needs to be done to improve. But somehow, you don’t do it and try to “prove yourself otherwise” instead. More often than not, your ego is the one big obstacle which prevents you from achieving consistent profits in the Forex market. You feel the rush when you actually go against rules – and win the trade.In Forex, you can “trade correctly and lose” and “trade wrongly and win.” Don’t be disillusioned by the latter. A word of advice: Do not pit your ego against a market that trades US$3 trillion in a single day. It will make you pay heavily for it.

Are you trading with support or resistance? Do an analysis today and you will be surprised at what you might discover about yourself.

0 comments:

Post a Comment